- Usaa Mobile Deposit Rules

- Usaa Mobile Deposit Instructions

- Usaa Mobile Deposit Cut Off Time

- Usaa Mobile Deposit Stimulus Check

- Usaa Mobile Deposit Not Working

- Usaa Mobile Deposit Faq

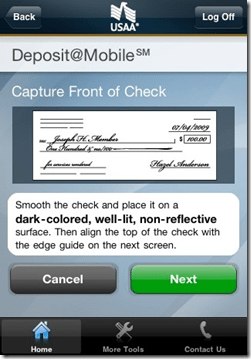

USAA Mobile gives you immediate and secure account access from your mobile device. Manage your finances, investments, insurance and much more—all from one convenient app.

Global poker freerolls. Insurer and financial-services provider United Services Automobile Association on Wednesday asked a federal court to dismiss a request by mobile remote deposit capture technology developer Mitek Systems Inc. for a declaratory judgment that Mitek's technology does not infringe on four USAA patents.

Earn Real Money Online from your favorite brands. Receive a text when it's time to log in to watch a short video, handpicked just for you. Earn a minimum of $0.50 and up to $3.00 per video interaction. MAKE MORE MONEY. InboxDollars is the #1 site for anyone looking to earn some extra money for watching videos, taking surveys, and other online activities. Sign Up Free Enter your email, pick a password, and start telling us. Commercial ads, movies, and TV shows online It's the perfect way to earn money at WinTub. Refer your friends. We'll confirm as soon as your friend joins. You get $1 and Your friend gets $5.

San Antonio, Texas-based USAA's dismissal request came less than a week after a jury awarded the company $102 million in damages from Wells Fargo & Co. at the end of a trial in which it determined Wells had infringed on two of USAA's mobile-capture patents. That award, made in U.S. District Court in Marshall, Texas, came about two months after USAA won $200 million from Wells in a separate patent-infringement trial involving two other mobile-capture patents.

USAA Last Updated 3 minutes ago: The United Services Automobile Association (USAA) is a San Antonio, Texas-based Fortune 500 diversified financial services group of companies including a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investing, and insurance to people and families who serve, or served, in the United States military. Qualifying members can use USAA Deposit@Mobile to deposit checks from your phone.-Use helpful tools. Try our loan calculator and ATM locator. Simplify your life and finances with the USAA Mobile App. USAA's Deposit@Mobile and Deposit@Home products, including the corresponding portions of this website or application, may be covered by one or more of the following United States Patents. Note 6 Zelle and the Zelle related marks are wholly owned by Early.

Although it was not a party to either of the USAA-Wells Fargo lawsuits, the litigation was of great concern to San Diego-based Mitek, the leading vendor in the mobile-capture industry, with its software used by thousands of financial institutions. Both USAA and Mitek are mobile-capture pioneers, with Mitek rolling out its first such software product in 2008. USAA developed mobile-capture software to serve its widely dispersed military customer base. Both companies had fought in court before over mobile-capture patents, but settled in 2014.

Usaa Mobile Deposit Rules

Citing its early development of mobile-capture software, USAA indicated about two years ago that it wanted financial institutions to license its technology. USAA's first big target was Wells, which it sued in June 2018 for alleged infringement of several of its patents. That case, also heard in the Marshall federal court, resulted in the $200 million damages award.

In August 2018, USAA filed its second lawsuit against Wells, resulting in the Jan. 10 verdict.

Noting its previous legal tussles with USAA and the widespread use of its software, Mitek named USAA as the defendant in a suit it filed Nov. 1 in U.S. District Court in San Francisco. Mitek said the purpose of the suit was to get a declaratory judgment that its technology does not infringe on four USAA patents.

In its dismissal motion, USAA accuses Mitek of 'an extreme attempt at forum shopping,' saying the San Francisco federal court does not have so-called 'subject-matter jurisdiction.' Plus, San Diego-based Mitek does not have any 'particular connection' to the court's jurisdiction, USAA claims. In the alternative, if it doesn't dismiss the case, USAA asked the court to transfer it to the federal court in Marshall, Texas, where the underlying issues already have been extensively litigated.

Usaa Mobile Deposit Instructions

It's unclear when the court will rule on the motion. A Mitek spokesperson did not respond to a Digital Transactions News request for comment.

Meanwhile, San Francisco-based Wall Fargo says it disagrees with the latest jury verdict, but it hasn't stated what it will do next.

Usaa Mobile Deposit Cut Off Time

'We believe this is an industry issue involving numerous other banks that license remote mobile deposit technology from the same vendor, not USAA,' a spokesperson for San Francisco-based Wells says by email. 'We are considering our options based on the verdict and trial. Wells Fargo has been and continues to be a leader in enabling seamless payments and mobile-banking experiences, and this ruling has no impact on our customers' ability to remotely deposit checks or the company's work to provide innovative tools and technologies to our customers.'

Usaa Mobile Deposit Stimulus Check

Nathan McKinley, USAA vice president of corporate development, said in a statement that 'this verdict further validates our position that we created mobile deposit capture technology. Wells Fargo, and the rest of the banking industry, has benefited from our technology and we look forward to working with banks to create reasonable and mutually beneficial license agreements. Our goal has always been to be reasonably compensated for the investment in mobile banking innovation we have made on behalf of our members and the military community.'

Usaa Mobile Deposit Not Working

San Antonio, Texas-based USAA's dismissal request came less than a week after a jury awarded the company $102 million in damages from Wells Fargo & Co. at the end of a trial in which it determined Wells had infringed on two of USAA's mobile-capture patents. That award, made in U.S. District Court in Marshall, Texas, came about two months after USAA won $200 million from Wells in a separate patent-infringement trial involving two other mobile-capture patents.

USAA Last Updated 3 minutes ago: The United Services Automobile Association (USAA) is a San Antonio, Texas-based Fortune 500 diversified financial services group of companies including a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investing, and insurance to people and families who serve, or served, in the United States military. Qualifying members can use USAA Deposit@Mobile to deposit checks from your phone.-Use helpful tools. Try our loan calculator and ATM locator. Simplify your life and finances with the USAA Mobile App. USAA's Deposit@Mobile and Deposit@Home products, including the corresponding portions of this website or application, may be covered by one or more of the following United States Patents. Note 6 Zelle and the Zelle related marks are wholly owned by Early.

Although it was not a party to either of the USAA-Wells Fargo lawsuits, the litigation was of great concern to San Diego-based Mitek, the leading vendor in the mobile-capture industry, with its software used by thousands of financial institutions. Both USAA and Mitek are mobile-capture pioneers, with Mitek rolling out its first such software product in 2008. USAA developed mobile-capture software to serve its widely dispersed military customer base. Both companies had fought in court before over mobile-capture patents, but settled in 2014.

Usaa Mobile Deposit Rules

Citing its early development of mobile-capture software, USAA indicated about two years ago that it wanted financial institutions to license its technology. USAA's first big target was Wells, which it sued in June 2018 for alleged infringement of several of its patents. That case, also heard in the Marshall federal court, resulted in the $200 million damages award.

In August 2018, USAA filed its second lawsuit against Wells, resulting in the Jan. 10 verdict.

Noting its previous legal tussles with USAA and the widespread use of its software, Mitek named USAA as the defendant in a suit it filed Nov. 1 in U.S. District Court in San Francisco. Mitek said the purpose of the suit was to get a declaratory judgment that its technology does not infringe on four USAA patents.

In its dismissal motion, USAA accuses Mitek of 'an extreme attempt at forum shopping,' saying the San Francisco federal court does not have so-called 'subject-matter jurisdiction.' Plus, San Diego-based Mitek does not have any 'particular connection' to the court's jurisdiction, USAA claims. In the alternative, if it doesn't dismiss the case, USAA asked the court to transfer it to the federal court in Marshall, Texas, where the underlying issues already have been extensively litigated.

Usaa Mobile Deposit Instructions

It's unclear when the court will rule on the motion. A Mitek spokesperson did not respond to a Digital Transactions News request for comment.

Meanwhile, San Francisco-based Wall Fargo says it disagrees with the latest jury verdict, but it hasn't stated what it will do next.

Usaa Mobile Deposit Cut Off Time

'We believe this is an industry issue involving numerous other banks that license remote mobile deposit technology from the same vendor, not USAA,' a spokesperson for San Francisco-based Wells says by email. 'We are considering our options based on the verdict and trial. Wells Fargo has been and continues to be a leader in enabling seamless payments and mobile-banking experiences, and this ruling has no impact on our customers' ability to remotely deposit checks or the company's work to provide innovative tools and technologies to our customers.'

Usaa Mobile Deposit Stimulus Check

Nathan McKinley, USAA vice president of corporate development, said in a statement that 'this verdict further validates our position that we created mobile deposit capture technology. Wells Fargo, and the rest of the banking industry, has benefited from our technology and we look forward to working with banks to create reasonable and mutually beneficial license agreements. Our goal has always been to be reasonably compensated for the investment in mobile banking innovation we have made on behalf of our members and the military community.'

Usaa Mobile Deposit Not Working

Usaa Mobile Deposit Faq

A USAA spokesperson tells Digital Transactions News the company has no comment beyond McKinley's statement.